This live event took on 15 February 2022!

Now in its 15th year, the Tax Magic webinar is recognised as a key event in the tax calendar.

It's not to late to access the webinar recording!

Our expert speakers will guide you through:

- Finance Act 2021 - explained section by section in plain English:

- tax and USC rates and bands

- remote working

- benefit in kind

- flight crews

- ARF/AMRF changes

- pre-letting expenditure

- non-resident landlords

- micro-generation of electricity

- EIIS changes

- capital allowance changes

- hybrid mismatches and interest limitation

- the new digital games relief

- VAT changes

- CAT changes

- stamp duty changes

- penalty changes

- residential zoned land tax (RZLT)

- Real life case studies and recent tax appeal cases.

- Q & A session with the panel - all tax topics - your chance to get answers to the questions that have been annoying you.

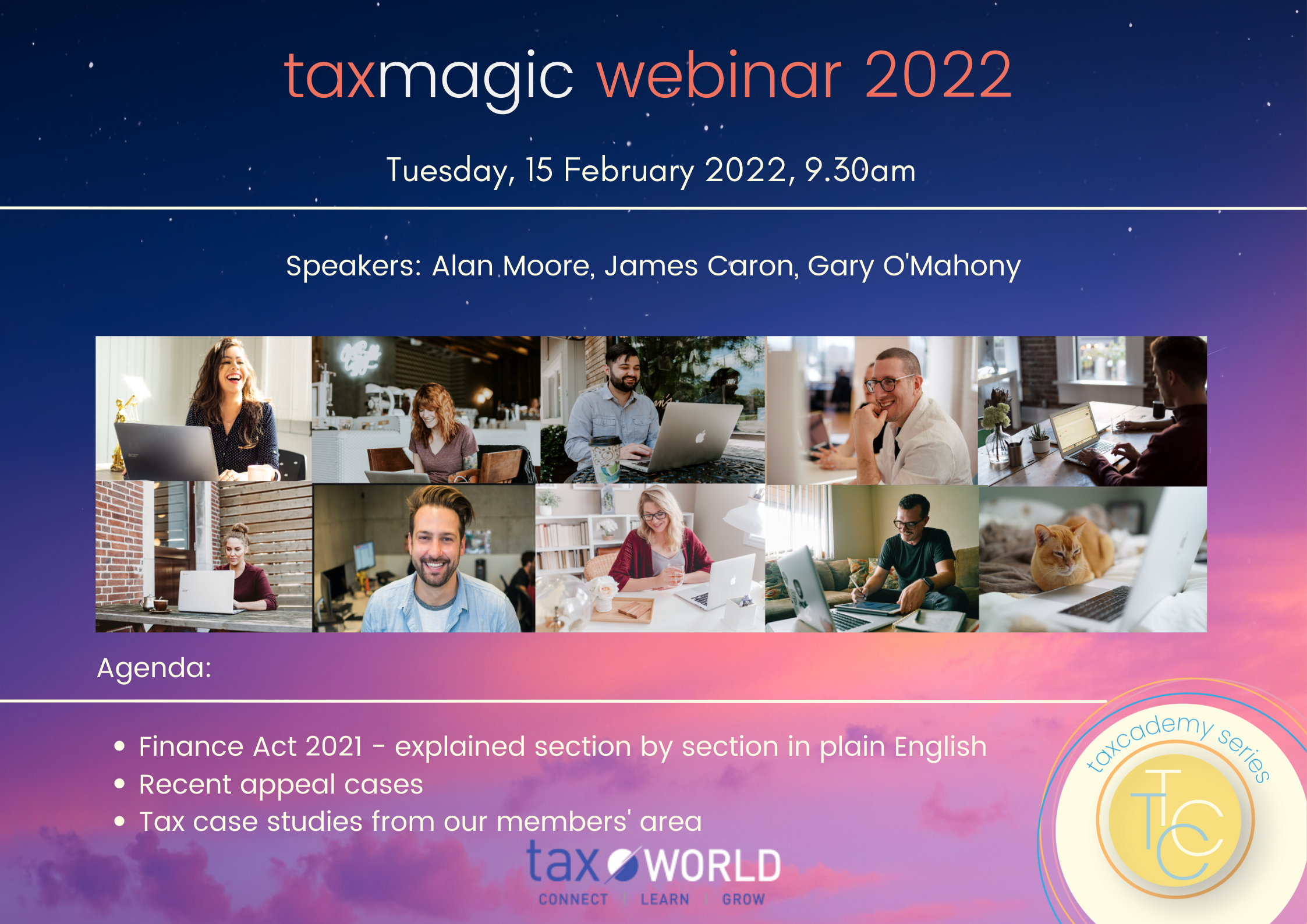

- Speakers:

- Alan Moore from Tax World Ltd

- James Caron from Lucas Financial Consulting

- Gary O'Mahony - Managing Partner with O'Hara Dolan & Co

| non-member | |

| 1 seat | €137 |

In addition to your 3 hours CPD, you will receive by post:

- taxmagic 2022

- tax guide 2022

- seminar handbook including slides (pdf)

Sincerely,

Alan Moore

Not a premium member? click here to join.